Answers to the question“what is utility-scale solar?” vary greatly within the solar project development industry. While there is no official utility-scale solar definition, most, if not all, large scale solar projects share common characteristics.

What is Utility-Scale Solar Power?

The primary defining characteristic of utility-scale solar projects are that they sell the power they generate directly into the electric grid. Often, utility-scale solar projects are described as being “in front of the meter” as opposed to distributed generation systems, which are “behind the meter” — i.e. a system that is paired with the energy load of a facility and supplies that facility directly with power. Beyond these key features, what is considered utility-scale solar is highly nuanced and determined by a number of factors including size, location, interconnection type and voltage, state policy, and where the solar power is ultimately sold and how.

Differences in Utility-Scale Solar Definitions

A good example of the challenge in defining utility-scale solar is “Community Solar.” Community solar connects “in front of the meter” and often has a larger system size than traditional Distributed Generation, but is still not considered utility-scale. In many markets, community solar falls under the state’s net metering program, just like “behind the meter” projects.

The Solar Energy Industries Association (SEIA), a leading trade group for solar developers, defines a solar project as utility-scale if it generates greater than 1 megawatt (MW) of solar energy. The National Renewable Energy Laboratory uses a 5 MW threshold to qualify utility-scale solar projects. Unfortunately, the size-based definitions used by SEIA and NREL do not provide a full answer, as most of the time, size requirements for utility-scale solar projects depend upon the market in which the project is being built. In some markets, the threshold is 2 MW and up, in others it’s as high as 25 MW and up.

How Urban Grid Defines Utility-Scale Solar Design

For Urban Grid, utility-scale solar projects are 20MW or greater in size, which is enough energy to power thousands of homes or major manufacturing facilities. Our definition of utility-scale solar is driven primarily by the business opportunity. Unlike “behind the meter” projects that can offset the retail electricity rate, projects 20 MW and above are almost always required to compete in the wholesale power markets with other “merchant” generators like coal and natural gas.

The Two Types of Wholesale Electricity Markets

Another key factor that helps us define utility-scale solar is the market design. At a high level, there are two types of wholesale electricity markets: Regulated Markets and Deregulated Markets.

Regulated Wholesale Power Markets

Regulated power markets, like those in the Southeast, are constrained by vertically integrated monopoly utilities. In these markets, utilities generally own and operate all of the generators, transmission lines, and distribution networks which take electricity from the power plants and deliver them to homes and businesses. In some cases, the utilities will buy power directly from renewable energy projects. In regulated markets, the utilities, and to a certain extent the Public Service Commission, sets the definitive markers for utility-scale versus not utility-scale solar.

Deregulated Wholesale Power Markets

Deregulated power markets are competitive, organized electricity markets. The power that’s generated becomes part of the wholesale electricity market where it is traded like any other commodity. These electricity grids, also known as Regional Transmission Organizations (RTOs) or Independent System Operators (ISOs) are considered to be interconnected, which allows for broad-based trading of electricity across geographies. In these markets, there is opportunity for financially settled Virtual Power Purchase Agreements and other unique offtake structures for utility-scale renewables. Territories such as PJM and MISO stretch across multiple states and allow power generators to sell energy at the market price for that electricity. Because of this structure, utility-scale solar projects like those that Urban Grid develops must be of a certain size, and be built efficiently so as to reduce the cost of the energy to a point where it’s competitive with other generators in that market.

Power Purchase Agreements

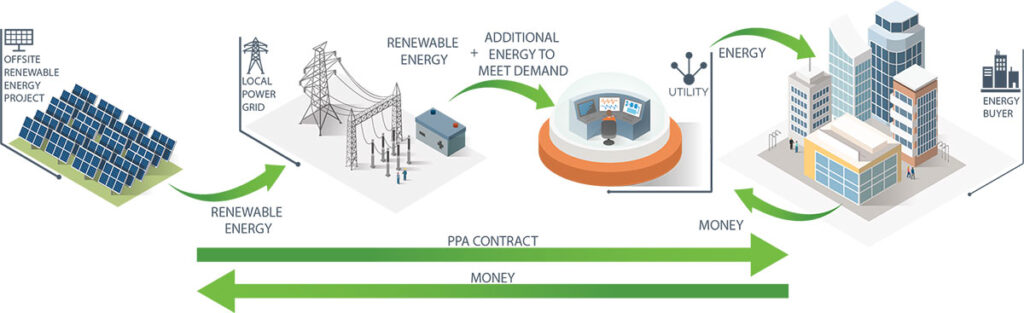

Utility-scale solar power projects require a certain kind of contracting mechanism in order to achieve the financing necessary to get constructed. As part of the solar project development process, utility-scale solar developers enter into a renewable energy contract called a Power Purchase Agreement (PPA) with utility, commercial, industrial and institutional customers. The PPA provides price and revenue certainty for the project’s energy over a fixed amount of time, with contracts usually spanning 12 to 20 years.

Virtual Power Purchase Agreements

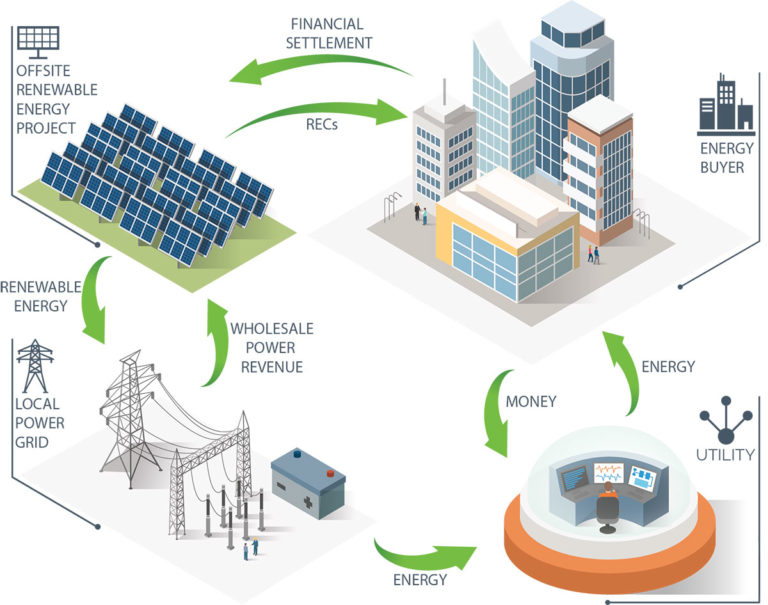

Increasingly, corporations have moved to PPA’s to take advantage of the low cost of utility-scale solar. Most of these agreements are in the form of a Virtual Power Purchase Agreement (VPPA), also known as a Synthetic PPA. In a VPPA, the power purchaser (offtaker) enters into a financial contract for differences based on the project’s solar energy at an agreed-upon price (strike price). The energy is then sold at market prices. If the market price is greater than the fixed VPPA price, the offtaker receives the difference. However, if the market price is less than the fixed VPPA price, the offtaker pays the project to make up the difference. Under this contract structure, a VPPA can act as a financial hedge against unpredictable electricity prices.

Unlike in a sleeved or retail PPA, with a VPPA, there is no physical delivery of power to the offtaker. However, the offtaker can choose to receive and retire the project’s Renewable Energy Credits (RECs) allowing them to make claims regarding their sustainability efforts. The retirement of bundled RECs also provides the opportunity to claim additionality, i.e responsibility for the direct addition of new renewable energy to the grid.

Retail Power Purchase Agreements (PPA)

The Retail PPA is a structure that is only suitable in deregulated retail electricity markets, such as Maryland and DC, in which customers can shop around for energy plans from retail energy providers. This consumer choice has led to an increased demand for renewables which can be purchased with a Retail PPA. In this scenario, the buyer enters an agreement with their retail electricity supplier and takes delivery and title to a renewable project’s energy. In many cases, the buyer also receives the RECs as part of the agreement. In other cases, the project sells the RECs on the market separately to improve the PPA’s economics.

The Future of Utility-Scale Solar Power

According to the SEIA, there are over 100,000 MW of utility-scale solar projects currently in operation, or under development. Due to government and corporate sustainability targets (like the RE 100), continued declines in the cost of solar, and the spread of solar-plus-storage, we expect to see utility-scale solar capacity grow by double digits between now and 2020.