A Virtual Power Purchase Agreement (VPPA), also known as a Synthetic PPA, or Contract for Differences, is a popular type of renewable energy contracting structure that provides a financial hedge against future energy fluctuations. The VPPA structure supports bringing new, clean renewable energy onto the grid on behalf of the offtaker, and opens the door for meeting an organization’s sustainability goals as well as additional marketing opportunities. While the Virtual PPA can be a complicated undertaking, working with a partner like Urban Grid will help ensure your organization achieves their renewable energy goals, while limiting exposure to unnecessary risks.

What is A Virtual PPA?

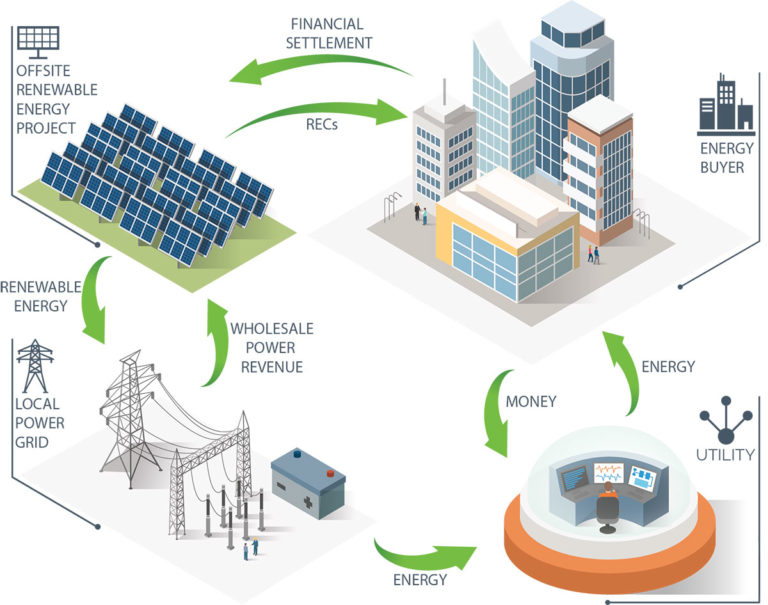

A Virtual PPA is a contract structure in which a power buyer (or offtaker) agrees to purchase a project’s renewable energy for a pre-agreed price. In this agreement, the utility-scale solar project receives the market price at the time the energy is sold.

If the market price is greater than the fixed VPPA price, the offtaker/buyer receives the difference.

If the market price is less than the fixed VPPA price, the offtaker/buyer pays the project to make up the difference.

In this way, a Synthetic PPA acts as a financial hedge against volatile electricity prices. Typically, the buyer receives the project’s Renewable Attributes, or Renewable Energy Certificates (RECs). Because there is no physical delivery of power, the VPPA is a great option for large electricity consumers with a fragmented/distributed electric load to support the development of new renewable energy resources.

Is a VPPA a Contract to Buy Energy?

With a Synthetic PPA, there is no physical delivery of power to the buyer’s load centers. In fact, the buyer will continue to pay their utility bills as they always do. A Virtual PPA is a purely financial agreement that acts as a hedge on electricity prices. Additionally, the buyer receives the Renewable Energy Credits (RECs) as part of the VPPA, which allows the buyer to make claims regarding their greenhouse gas reductions and renewable energy purchase. Those with a financial background will recognize this structure as a Contract for Differences (CFD) or financial fixed-for-floating swap.

It is important to note here that VPPAs require market liquidity – where the project is permitted to sell its power directly into the grid for the prevailing wholesale market price. This is typically only possible in organized markets such as a regional transmission organization (RTO) or an independent system operator (ISO), which serve as third-party independent operators of the transmission system. Also, because VPPA economics rely on the difference between the floating market price and the VPPA price, it is important to have the transparency of an RTO/ISO market.

Benefits of a Synthetic PPA

Additionality

A Synthetic PPA guarantees the project a fixed price for its output, which is critical for developers that are looking to finance new projects. The energy and bundled RECs acquired through a VPPA are directly attributable to new “additional” renewable energy facility which is adding new clean energy to the grid and displacing fossil fuels. The project would not happen “but for” the VPPA and it is thus truly “additional” and impactful. As corporate renewable energy procurement and reporting on energy use and emissions faces increasing scrutiny, procuring bundled RECs will be the best practice for meeting corporate renewable energy goals.

Impact

Organizations exploring the VPPA structure are typically focused on sustainable business practices, reducing carbon footprint, and investing in renewable energy. Just as with any investment, the impact of these “green” initiatives is important in evaluating their true return of investment. For example, purchasing unbundled RECs is a low impact solution for achieving renewable energy goals. These RECs are easily attainable, may come from new or existing resources anywhere in the county, from any “renewable” energy resource. Signing a Synthetic PPA with a new solar project is substantially more impactful as the long-term contractual commitment to buy the project’s energy enables the development of the project and the inclusion of the Bundled RECs recognizes the clean power production. This enables organizations to claim that their renewable energy purchase has a direct and meaningful impact on the addition of a new renewable energy project. This impact translates to significant marketing and branding opportunities and organizations are certainly jumping on board.

Positive Net Present Value

Unlike a traditional Unbundled REC purchase, which always costs money, the VPPA swap provides RECs at a price determined by the net difference between the fixed VPPA Price and the wholesale market price. A positive difference between the market price and the fixed VPPA price can lead to significant positive cash flows. In many earlier VPPAs, the fixed VPPA price was at or above the market price, and the buyer had to look to price forecasts to determine if the project would eventually provide a positive NPV. Now, there are markets and projects where it is possible to secure a fixed VPPA price which is below the current market price, meaning that the Virtual PPA will generate positive cash flow beginning day one.

Ability to Offset Dispersed Load

VPPAs are flexible and can help companies aggregate their load to a single renewable energy project under a single PPA, regardless of where their individual facilities are located. The VPPA is a separate financial contract that, in fact, does not affect the traditional electricity supply for an organization directly. The organization continues to purchase electricity from the utility, in addition, enters the VPPA for renewable energy.

Hedge

By entering a long term Synthetic PPA, the buyer is locking in a price for Bundled RECs based on the wholesale market price of electricity. If wholesale prices rise, then the buyer’s conventional energy supply costs will also likely rise. The buyer will likely make money on the VPPA deal and the profits made can offset higher conventional energy costs. Conversely, if the VPPA price is greater than the wholesale market price, the buyer will be paying the net difference to the project to provide their required fixed revenue stream, but they will also likely realize lower conventional energy costs. In this regard, the VPPA acts as a hedge against rising conventional energy costs.

Learn More About VPPAs

VPPA Structure: Legal, Accounting and Regulatory

Power purchase agreements, especially VPPAs, can raise internal accounting issues. While we cannot provide accounting advice in this blog, there have been numerous VPPA’s structured and executed by all types of organizations. We recommend discussing the accounting impacts with your accountant early on to ensure proper internal accounting treatment.

Another important regulatory consideration to ensure you understand when evaluating a VPPA is the impact of the Dodd-Frank Act. Because a VPPA is a fixed for floating swap, it is subject to Dodd-Frank, which requires registration and reporting of the transactions. In most cases, the renewable energy project owner will perform these tasks on your behalf, but it is important to confirm this in the negotiation of the VPPA. If you are a financial services firm, you may be subject to additional obligations for filing under Dodd-Frank. Again, we recommend involving your internal legal and accounting team early in the process to answer these questions. A good VPPA partner can help with understanding the contract structure and how it’s unique terms may impact your organization.

Advancing Renewable Energy Is Good Business Leadership

If your company is looking for impactful ways to reduce your collective carbon footprint, that also includes financial and marketing benefits, the Virtual PPA may be a workable option for a growing number of companies.

Interested in learning more about how your company can make a difference with renewable energy? Contact Urban Grid Solar.