For renewable energy buyers looking to demonstrate leadership by increasing the effectiveness of their sustainability projects, understanding the importance of additionality is critical.

What Is Additionality?

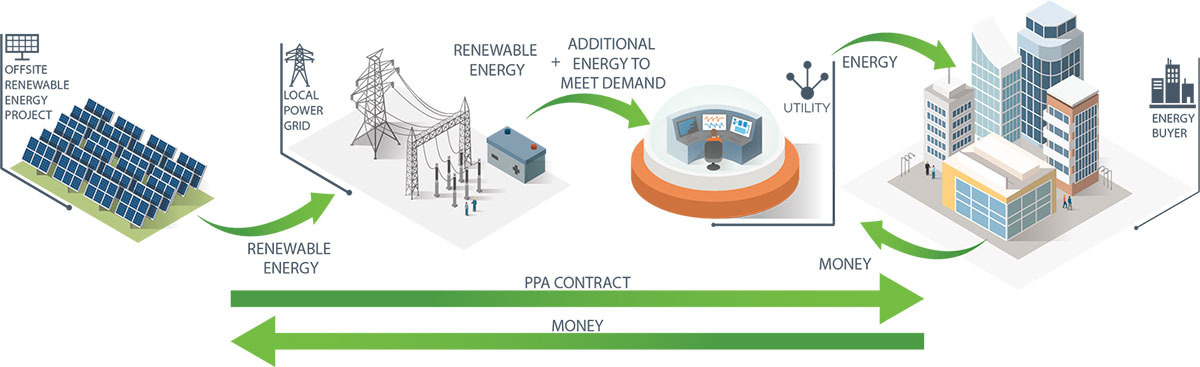

Additionality is a term adopted by the renewable energy industry to describe when an organization’s power purchase agreement (PPA) has the direct effect of adding new renewable energy generation to the grid; i.e.without the organization’s involvement (via the PPA) the clean energy project would not have happened.

Additionality in the carbon offset and renewable energy markets

The concept of additionality originated in the carbon offset markets where it described projects that resulted in verifiable emissions reduction or avoidance. Today, additionality is often used in a similar way in the renewable energy credit market.

How to claim RECs while realizing additionality

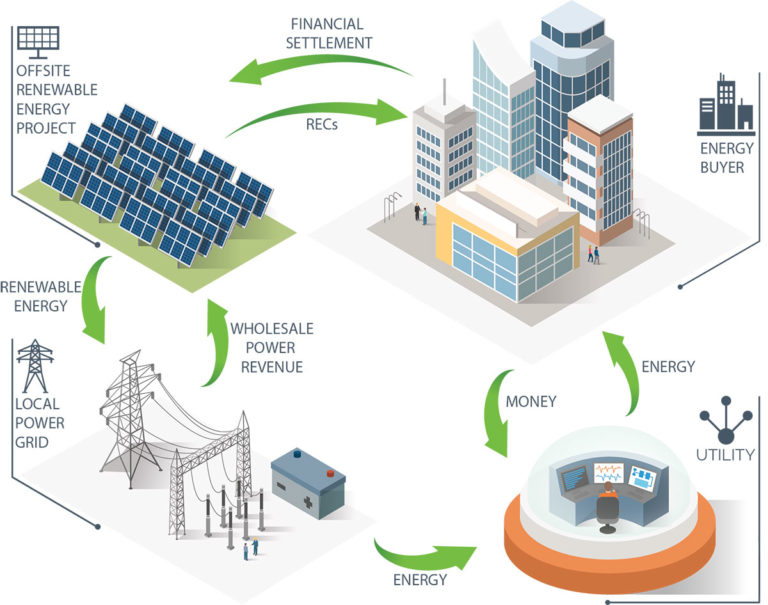

Achieving additionality requires entering into a long term power purchase agreement (typically either a Sleeved PPA or Virtual PPA) with a new renewable energy facility and retiring the RECs. It is this long term commitment to buy the project’s energy and RECs that provides the new renewable project the contracted revenue necessary to finance and construct the project. RECs bundled with energy via a Sleeved or Virtual Power Purchase Agreement allows your organization to make the claim that, without your organization’s investment, the renewable energy project would not have been built.

The purchase of unbundled RECs (meaning RECs purchased separately from the original energy production) makes claims of additionality challenging. Due to the success of the renewable energy market, RECs are oversupplied which has yielded extremely low prices, hence they are providing little to no financial impact on the facilities they come from. Unbundled RECs purchased in the marketplace, are not limited by geography and can be generated by a variety of resources including wind, biomass, even trash incineration in some markets. If you do plan on purchasing unbundled RECs to offset your electricity usage, it is important to work with your broker or developer partner to ensure clarity on where the RECs are being generated.

If You’re In the Renewable Energy Market, You Should Care About Additionality

Companies are being increasingly pressured to become more sustainable by both internal and external stakeholders. Being able to claim additionality is a huge indicator to customers, investors, and employees that your organization is leading the charge on the sustainability front by clearly driving the construction of new renewable energy projects. Leading companies such as Bloomberg, General Motors, Iron Mountain and The Home Depot have embraced the importance of impacting the electricity grid by ensuring their market participation adds incremental renewables to the grid. As of October 2018, 78 companies have signed on to the WWF/WRI Corporate Renewable Energy Buyers Principles, the fourth principle of which states the signatories’ desire to have “access to new projects that reduce emissions beyond business as usual … we would like our efforts to result in new renewable power generation.” Claiming additionality through a PPA or Virtual PPA is tangible proof that your company is actively working to make a difference in the environment by achieving its sustainability goals.

Additionality from Renewable Energy Is Finally Achievable For Most Organizations

Aside from the mounting pressure to do more, companies are now looking for ways to achieve additionality because they’re increasingly able to do so in a cost-effective and cost-competitive way. Corporations like Microsoft, Google, and Facebook were able to achieve additionality early on, but because of cost barriers, many smaller and mid-size organizations weren’t able to invest money into renewable energy projects. Now, because of Power Purchase Agreements, that’s no longer the case. Any organization can sign onto a PPA and purchase a large amount of RECs in a way that makes financial sense. Companies can even partner with other organizations to finance large projects, by signing onto a PPA together.

How To Achieve Additionality

In the renewable energy industry, there are two ways to achieve additionality. The first is to enter into a Power Purchase Agreement with a clean energy project that includes bundled RECs. The PPA/VPPA ensures the financing and therefore the construction of the project, and the RECs provide the environmental attributes. Another less advertised strategy for ensuring additionality in your renewable energy venture is through the direct investment in a clean energy project and the subsequent purchase of the RECs.

The structure, location, and price of a Power Purchase Agreement do not affect additionality claims, and additionality from renewable energy can be shared amongst multiple buyers (investors).

The Future of Corporate Renewable Energy Procurement

Even now, some organizations are starting to think beyond whether their actions are resulting in additionality, and more towards whether they’re offsetting as much greenhouse gas as they possibly can. For example, companies are beginning to seek clean energy projects in regions with higher levels of dirty power sources. These projects will have the largest potential impact of displacing fossil fuel use or GHG emissions reductions. In addition, we predict that there will be a shift towards investing in project portfolios that include multiple renewable sources and locations, that, together, can deliver carbon-free renewable energy to match a company’s load 24 hours a day, 7 days a week in real-time.

If you’d like to talk about how your organization can meet its sustainability goals and achieve additionality through renewable energy procurement, contact Urban Grid today.