What Is A Sleeved PPA?

As a large organization, a Power Purchase Agreement (PPA) is often the most accessible and effective way for an organization to procure large amounts of renewable energy. The two most common types of PPAs are sleeved PPAs, also called a direct PPA or retail PPA, and Virtual Power Purchase Agreements (VPPAs). According to the Business Renewables Center, about 20% of large-scale corporate renewable energy deals are sleeved PPAs.

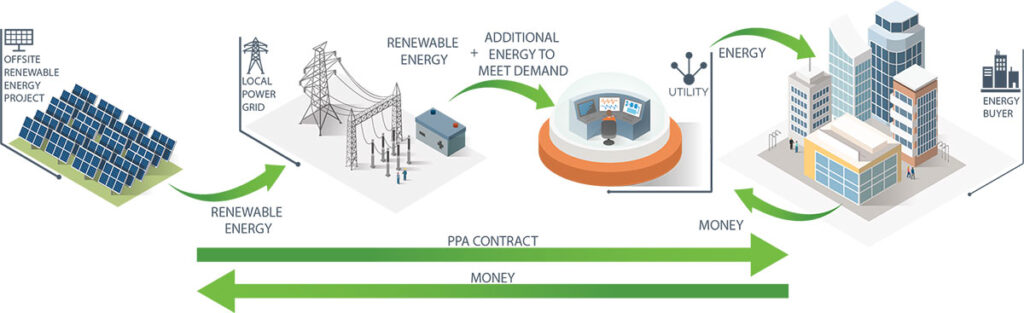

In a sleeved PPA, an intermediary utility company handles the transfer of money and energy to and from a renewable energy (RE) project on behalf of the buyer. The utility takes the energy directly from the RE project and “sleeves” it to the buyer at its point of intake, for a fee. If the purchased renewable energy isn’t enough to meet the buyer’s energy needs, the utility is also responsible for supplying the additional power required.

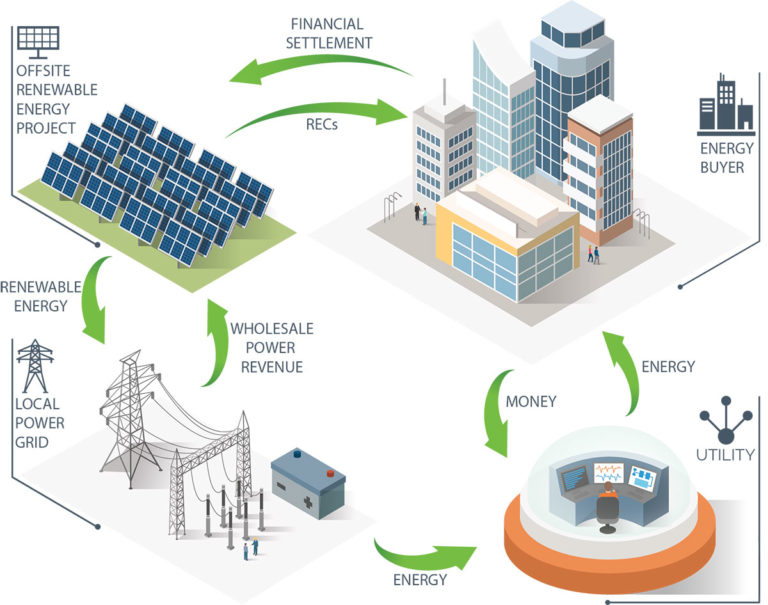

A Sleeved (Direct) vs. Virtual PPA

If you’ve weighed the risks and benefits of a VPPA for your renewables purchase and are uncomfortable with the level of risk, a sleeved PPA may be a good option to explore. Unlike a VPPA, in a sleeved PPA:

- The buyer does not need to be intimately familiar with wholesale power market dynamics; and

- The buyer is not subject to wholesale power market price fluctuations because the utility bears the market risk

Additionally, a sleeved PPA is the best renewables purchase option available when:

- The buyer is not set up to be able to purchase balancing power — power that’s needed when renewable energy isn’t available due to weather conditions or time of day

Some very large and sophisticated organizations have set up mini utility models to avoid having to purchase balancing power, but this requires a large investment of both capital and time to gain expertise.

- The buyer is in a regulated electricity market that does not have a Regional Transmission Organization (RTO) or Independent System Operator (ISO) — like the Southeastern U.S.

- The buyer is in a deregulated energy market, like Maryland or Pennsylvania, where the sleeved PPA mirrors an electricity supply contract.

Sleeved PPAs in Regulated vs. Deregulated Markets

Given their nature, sleeved PPAs are much more common in deregulated markets, but they can also exist in regulated wholesale power markets as well.

How Sleeved PPAs Work in Deregulated Markets

If you operate in a deregulated electricity market, a sleeved PPA — also referred to as a Direct PPA or Retail PPA — is a great tool for purchasing renewable energy to meet corporate sustainability goals. They’re particularly advantageous for organizations with large, fragmented loads or limited onsite opportunities. By sleeving your PPA with a utility supplier, you gain key benefits while reducing your organization’s exposure to market risks:

- The utility assumes the market (price), volume and shaping, and basis risks

- Reliability of power supply – power when the renewable project is not producing

- Long term, fixed rate for power

- Control over power-pricing relationship vs. paying a tariff set by the utility

- Easier verification that energy is procured from a particular renewable source

- No upfront costs or capital expenditure requirements

- Option to claim additionality — indicating that your organization is driving the construction of new RE projects

Sleeved PPAs generally have few drawbacks, with the most common ones being:

- The contract involves three parties — Energy Buyer, Utility, RE Project

- The buyer must pay the utility a fee for management, sometimes called a ‘sleeving fee’

Sleeved PPAs in Regulated Markets

The most common way a buyer can enter into a sleeved PPA within a regulated power market is through a Green Tariff. With a Green Energy Tariff, the utility supplies the customer with up to 100% renewable power from projects controlled by the utility. Green Tariffs come in many forms, so take time to look at a Green Energy Tariff comparison, to familiarize yourself with the differences between each.

The most common type of Green Energy Tariff explained

The most common type of Green Tariff in the utility scale renewables market is the type where the utility passes the terms and structure of a PPA with a RE project through to a customer. In most cases, they avoid shifting costs and risks to non-participating customers. And typically, the customer can purchase Renewable Energy Credits (RECs) and other environmental attributes from the contracted RE projects. Unlike deregulated markets, when entering into a sleeved PPA through a Green Energy Tariff, the buyer gives up much more control to the utility.

Explore Your PPA Sleeving Options

If your company is looking for a risk-averse solution to meeting its sustainability goals, a direct PPA is worth exploring. Learn more about how you can meet your energy needs while simultaneously reducing your collective carbon footprint. Contact Urban Grid Solar today.